Credit Checks

Background Screening Index 2014

Download the full Background Screening Index 2014

Quick Jump:

Credit Checks

The Credit Amnesty was a hot topic in 2014. It caused mass confusion and misinterpretation by the general public and companies alike. Fortunately the fog has cleared and so let us take a closer look at what this has meant to us as South Africans.

Based on the Amnesty one would assume that the credit market would be healthier; however, according to statistics by the NCR, the Consumer Credit Market Report (Second Quarter June 2014) showed an increase in all components related to the credit market:

- The value of mortgages granted increased by 7.60% quarter-on-quarter from R30.84 billion to R33.18 billion;

- Secured credit granted, showed an increase from R35.35 billion for March 2014 to R35.76 billion for June 2014 (a quarter-on-quarter increase of 1.14%)

- Unsecured credit agreements increased from R18.82 billion for March 2014 to R19.32 billion for June 2014 (a quarter-on-quarter increase of 2.64%);

- Credit facilities which consist mainly of credit cards, store cards and bank overdrafts increased by 2.31% quarter-on-quarter from R16.22 billion to R16.59 billion;

- Short-term credit showed a quarter-on-quarter increase of 4.75% from R1.23 billion to R1.29 billion;

- Developmental credit showed a quarter-on-quarter decrease of 66.53% from R3.14 billion to R1.05 billion.

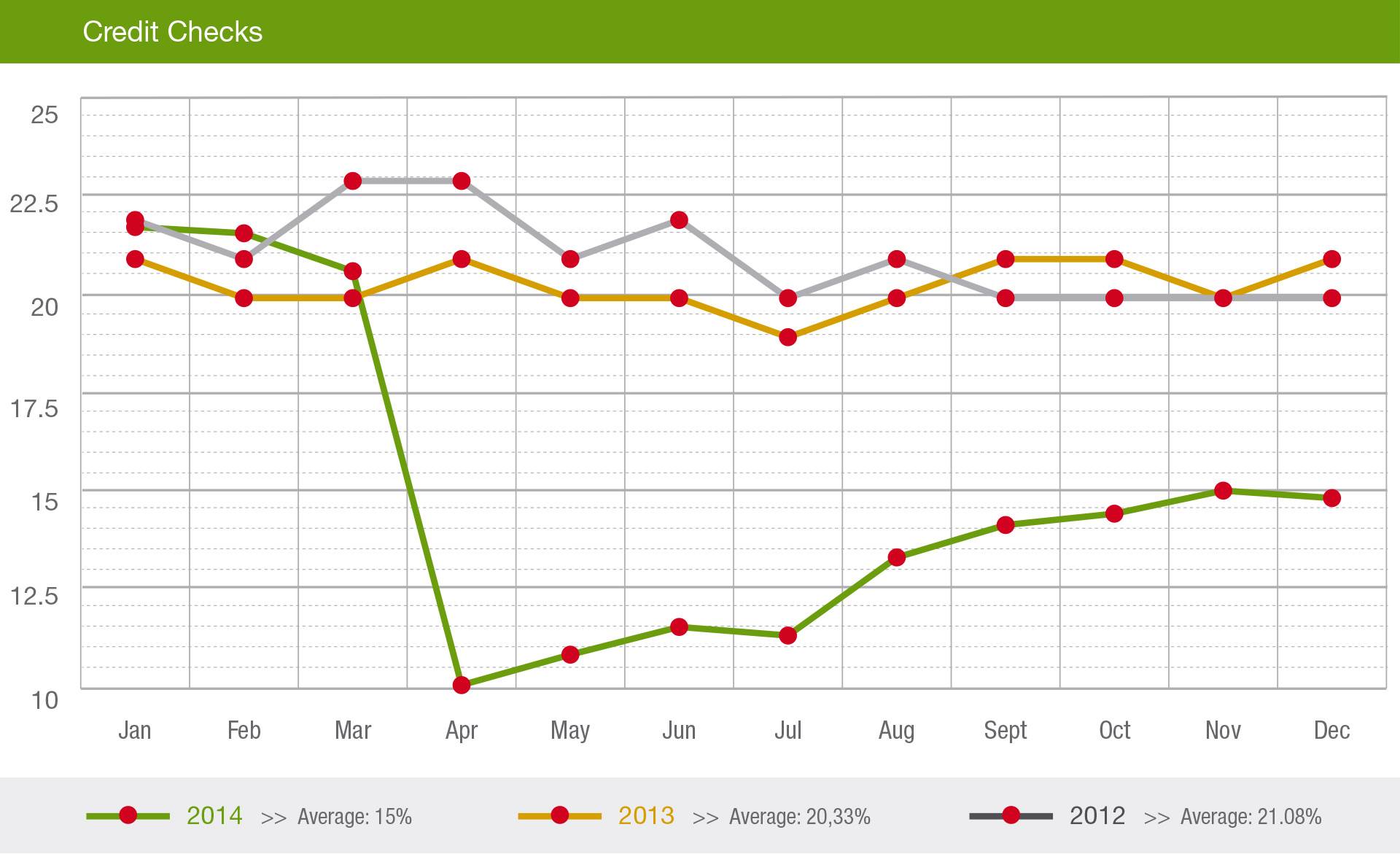

The graph below indicates the influence and severe impact that the Credit Amnesty forced upon the market. MIE reported that the percentage risk for credit checks in 2012 was on average 21% and for 2013 20%. For the year 2014 the percentage risk plummeted to a staggering 15%.

Credit Checks (Click to ZOOM)

Credit Checks (Click to ZOOM)